Debt Advisory

We support our clients’ funding needs by sourcing and assessing alternative funding sources at different price levels, in specific rating situations and in relation to varied purposes such as the financing of development plans and refinancing of expiring credit lines and loans.

The well-established relationships we have earned with commercial banks, financial institutions and other market participants such as debt funds, alternative investment funds, mini-bond funds, enable us to identify the most appropriate lenders and/or funders.

The main phases of our advisory services can be summarized as follows:

- Feasibility study

- Identification of potential lenders and preliminary contacts

- Preparation of the information package

- Assistance in negotiations with lenders in the preliminary stages and up to closing.

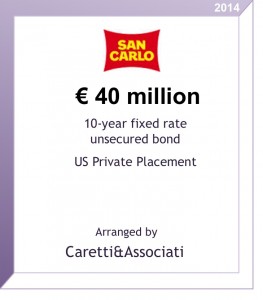

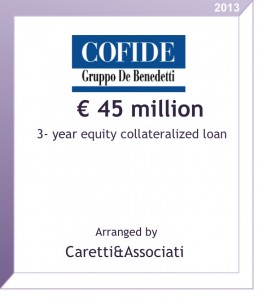

Examples of transactions